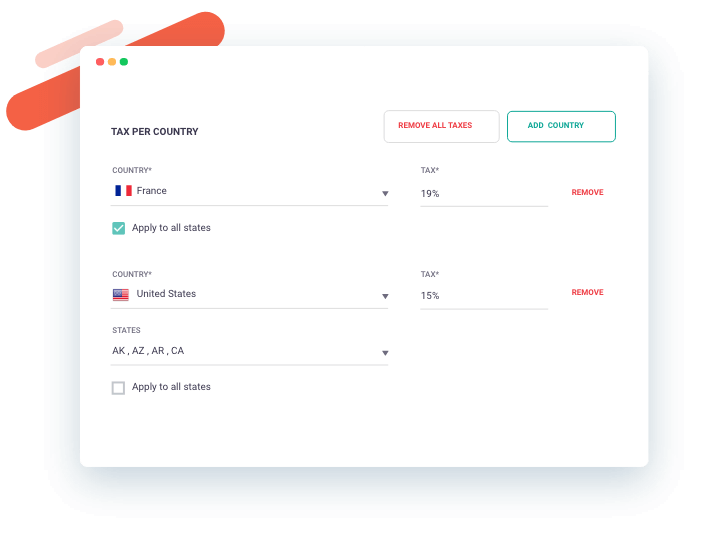

Nummuspay makes the tax management easier than ever. Nummuspay automatically calculates the appropriate sales tax based on the address of customers’ business. However, you will be able to edit actual tax rates, define new tax rates, remove tax from catalog price for nontaxable regions and more.

Tax

Management

Spend less time on sales tax calculation, focus on your profits.

Custom Taxes

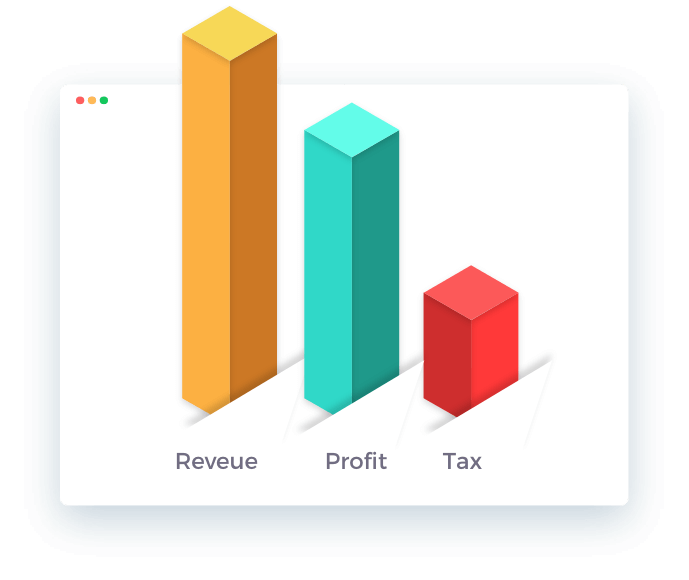

Easily Track Sales Tax

from Total Revenue

Sales turnover is the company’s total amount of products or services sold over a given period of time. But how to count the total profits? Nummuspay separates sales tax from total revenue, saving you valuable time for your business.

Easily Track Sales Tax

from Total Revenue

Sales turnover is the company’s total amount of products or services sold over a given period of time. But how to count the total profits? Nummuspay separates sales tax from total revenue, saving you valuable time for your business.

Manage Tax Prices for B2B EU Customers

When you work in a B2B environment, companies usually negotiate prices with taxes excluded. Nummuspay verifies customers’ professional vat and automatically deducts tax from catalog price for nontaxable regions. This feature is only available for B2B EU customers.

Auto-verification for EU Customers

Nummuspay delivers a unique feature specially for European customers. It provides auto- verification for each EU costumer who add his/her tax registration number in register page. So, EU customers lost no time to fill in more blank fields.

Auto-verification for EU Customers

Nummuspay delivers a unique feature specially for European customers. It provides auto- verification for each EU costumer who add his/her tax registration number in register page. So, EU customers lost no time to fill in more blank fields.